Thursday, August 31, 2006

>Weekly Commodity Analysis

This charts are updated weekly or sooner.

>Notice to replace securites with cash towards collateral

Subject: Notice to replace securites with cash towards collateral

Dear Client,

As you are all aware, NSCCL has asked Professional Clearing Members (PCMs) like SHCIL to submit the auditor's certificate indicating that the securities pledged in favour of NSCCL are owned by the PCMs. However, being a Professional Clearing Member, SHCIL does not own the securities which are received by SHCIL from its Trading Members on account of collateral. As such it is proposed to replace these securities with cash.

In order to meet with this requirement, we hereby request you to replace securities deposited by you with SHCIL with cash immediately. SHCIL is arranging to get the bank guarantees from various banks and the proposals with these banks are at various stages of completion. Once we get the sufficient bank guarantees from these bankers, we may start accepting the securities from you. However SHCIL will have to levy some charge on the securities placed by you with it.

In the meanwhile, latest by September 7th, 2006 we request you to withdraw the securities placed with us as a collateral and replace the securities with only cash to maintain your level of collateral intact to enable you to

trade normally.

On September 7th, 2006 EOD the benefit on account of securities will be withdrawn.

>Commodity market cycles. Dr Marc Faber

Should commodities, having approximately trebled in price since 2001, be sold, or should we expect far more substantial price increases? I have to confess that I have little confidence that I can answer these questions satisfactorily. Still, the following should be considered.

read more here...>>

Saturday, August 26, 2006

>Cooling Real Estate

1. Companies tend to blame their disappointing results on phenomena that have little to do with their actual operations. Starbucks, for example, recently blamed its poor results on the heat and the ensuing demand it created for time-consuming Frappuccinos. Lame excuses do tend to contain a kernel of truth. The demand for coffee might well decline when the mercury tops 100. So, it's no surprise that companies are now starting to attribute their adverse results to the cooling real estate market. for more read here

2. What with low housing starts, declining builder confidence, soft sales of existing homes, growing inventories, and surging foreclosures, anyone looking to sell a house these days is likely to be a bit stressed out. Except for top executives at big public companies. Yes, the executives who were first in line with jets, sweetheart loans, stock options, and repriced stock options have now devised the first post-real-estate bubble compensation trick. They've figured out how to shelter their own houses from the declining real estate market—by getting their corporations to guarantee their sale price. You may be sweating that you have to sell at a loss, but your CEO isn't... read more here

3. The lead story on the cover of today’s Wall Street Journal discussed the slumping housing market and a CEO of a major homebuilder as saying, “It would be difficult to characterize the position of the home builders as other than in a hard landing.” Some have made the argument that housing must be really bad since even the CEOs of homebuilding companies are so bearish.

.... read more here

4. Witter observes that we don't have a Housing bubble, what the U.S. has is a lending bubble. for more read here

5. Real Estate: About to Get Worse by Steve Sjuggerud, PhD

let us know your valued comments ..

Friday, August 25, 2006

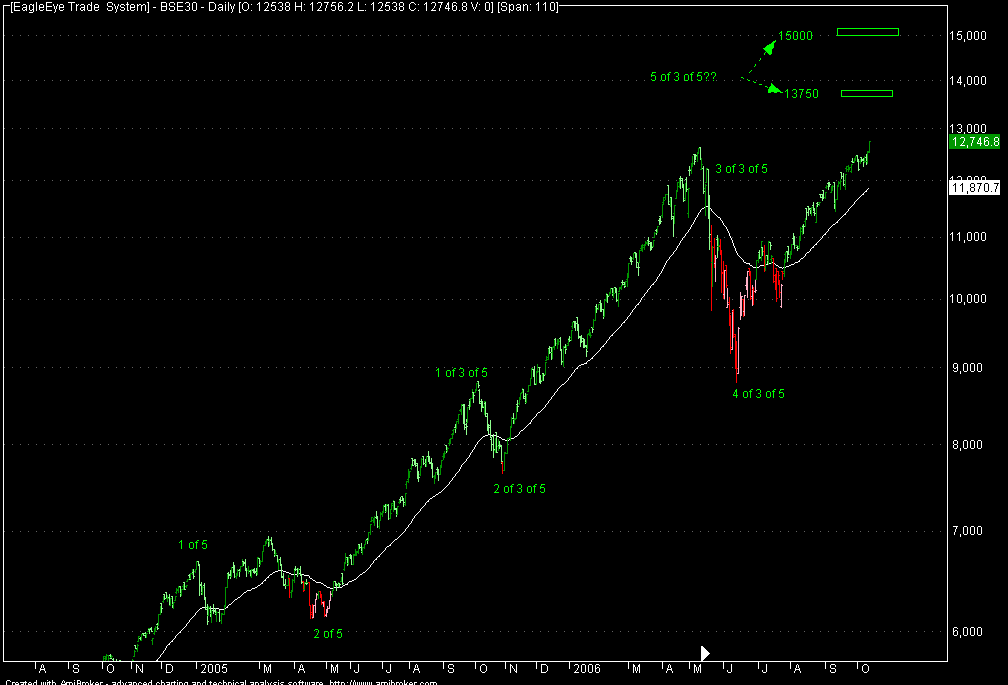

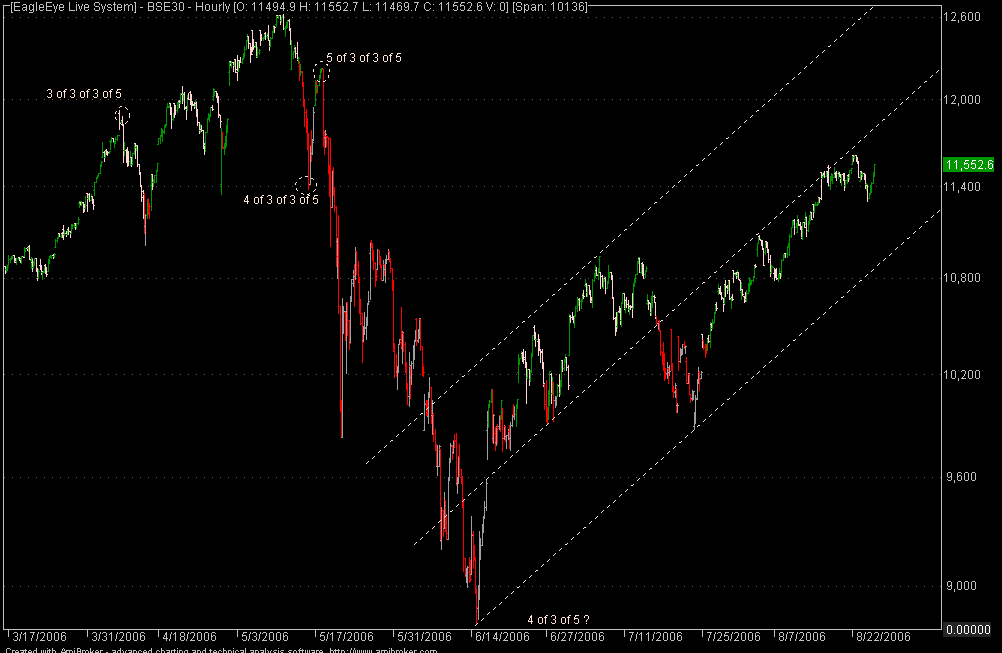

>Long Term Elliott Wave Count

The previous analysis was done when every Elliott Wave analyst on the street was predicting 2300 for NSE Index and 8000 for sensex.

We saw the Wave 5th of 3rd of 5th going up from 9000 to 12750 now.

12750<->12800 is an imp resistance now.

Beyond this we open up to 13750 to 1500 range in sensex.

Under attached is latest Chart of sensex.

========================================================

Previous Analysis was done onFriday, August 25,

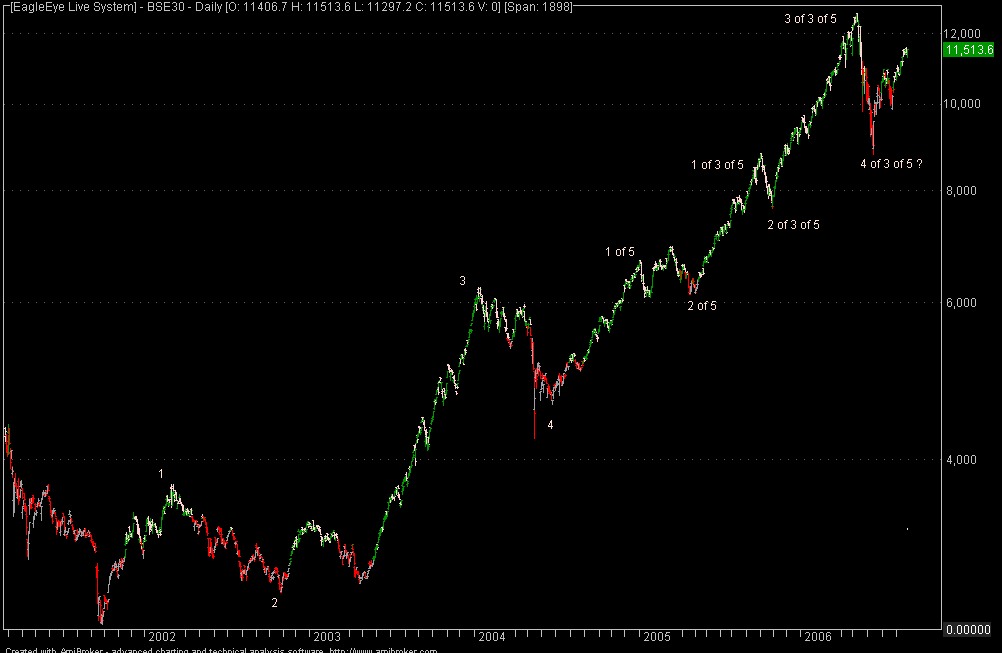

Long Term View.

- Wave 1 start from mid 2001

- We are currently in the 3rd of the 5th wave which started in 2001.

- The 5th wave is the extended wave and within this the 3rd wave is also extending.

- The correction of May-June 2006 was the 4th of 3rd of the 5th wave, as shown.

- It is not clear if the 4 of 3 of 5 is over.

- 4th waves often develop into triangles and this is not ruled out as yet. (can expect this to happen)

- In the longer term we have much more highs to see. When the 5th of 3 of 5 and the 5th of 5th plays itself out.

- The count from many el-wave analyst that we would fall to 2300 seems very unlikely at present.

- Note: This analysis applies to NSE Index also.

Longer Term chart showing multi year waves.

Beware booming asset markets - Dr. Marc Faber

Increased Recession Risks!

By Marc Faber

Pfäffikon, Switzerland

August 23, 2006

As we acquire more knowledge, things do not become more comprehensible, but more mysterious. -- Albert Schweitzer

According to Stephen Roach, “April was a critical turning point on the global rebalancing watch. After years of denial, the stewards of globalization — namely, the G-7 finance ministers and the IMF — finally sounded the alarm over the threat of mounting imbalances. The rebalancing fix that was endorsed has three key ingredients: the adoption of a multilateral global architecture of surveillance and consultation, general agreement on dollar depreciation, and a global tightening of monetary policies.” And after having warned for the last few years that the growing global imbalances would lead to some sort of crisis, Roach expressed optimism that “the good news is that none of this speaks of a terribly disruptive endgame for global rebalancing. Had global policy makers ignored the problem, a dollar crisis at some point in the not-so-distant future was a distinctive possibility. But now the combination of architectural reform, currency adjustments, and monetary tightening points toward a more orderly and hopefully benign strain of global rebalancing.” Still, Roach also warns: “It is important to stress that an orderly adjustment in the real economy is no guarantee of an orderly adjustment in liquidity-driven markets, especially those risky assets that have gone to excess.” for more read here

Beware booming asset markets!The upside potential for equities appears to be very limited despite the likelihood that the Fed will not increase the Fed fund rate at its August meeting. There is much resistance for the S&P 500 between 1290 and 1320 and technical conditions are not supportive of a strong and sustainable rally. for more read here..

The ominous rise around the globe of the resources-based corporate state is accelerating. The implications for the West are enormous, yet such implications are only beginning to be understood. As noted above, such states are concluding rapidly increased numbers of strategic agreements among themselves for the joint exploration and production of oil and gas, and with the rapidly rising powerhouse economies of the East, such as China and India, for the private long-term supply of oil and gas. for more read here

Part 2 - Mental Toughess is 90% of the Game

Wednesday, August 23, 2006

>Mental Toughess is 90% of the Game

I know it's hard to quantify, but how much of Tiger's achievement is physical and how much of it is the mental toughness?

At the professional level, the game is 90 percent mental.

Who do you see on tour who can do some of the same things Tiger can do physically?

Suffice it to say, there are players out there who are not capitalizing on their ability because of their lack of mental toughness.

Are there any players you particularly admire -- besides Tiger -- for their mental toughness?

No.

Anyone from another sport? Michael Jordan?

Yes. Michael Jordan is right there, but I was thinking of Cris Carter of the Minnesota Vikings. He's talented, but the thing that sets him apart is his mental toughness. Jim Brown -- mentally, mentally tough. John Elway. Joe Montana. These are guys who transcend the game by virtue of their mental toughness.

There you have it. According to his father, its the mental part of the game that separates Tiger from the field. Why is it that Tiger is 12-12 in winning the tournament when he has a share of the lead going into the final round? Its because he is able to lock out every emotion and be in the zone when other players can't or won't. He seems to be impervious to the pressure. He was able to do it because he was the recipient of mental toughness training from a Green Beret. Most of the other players on the tour have enough mental toughness to be at the top of their field, but not enough to win with the pressure on.

I don't think we are born mentally tough. Some of us have a higher tolerance for pain than others. For the most part, we need a mentor or a role model to show that there is more potential in most of us than we care to realize. Some of us succeed because we saw how our parents did it. Others because we were lucky enough to have a teacher or coach who pushed us to the limit and got more out of us than we knew we had. Once you get to that level, I won't say it becomes routine, but we do know where the marker for excellence is.

I'm studying mental toughness under Steve Siebold, a former professional tennis player who was good enough to make the circuit but not good enough to win. Mr. Siebold dedicated the rest of his life to learning what he missed in not being able to win consistently. It took 20 years but he mastered the art of mental toughness, first by being the partner of the great Bill Gove and later by developing a whose who list of corporate clients. Siebold has books and tapes as well as a Mental Toughness University which is primarily for corporate clients.

The main reason most people are not as mentally tough as they could be is because they really don't have a mission or vision for their life that really juices them enough to want to run through walls. Many people don't know what they want out of life. THAT'S A MAJOR PREREQUISITE.

Assuming you do know what you want, you have to make the decision that you are going to go for it with intelligent passion. We've heard the saying, a winner never quits and a quitter never wins. That's true, but if something is not working, you can't keep banging your head against the wall. You must make adjustments and improvements to get to the next level. The irony of a strong person is the ability to admit when they are wrong. I know the role model for toughness is John Wayne (I'm old enough) or Arnold Schwarzenegger. But tough people are confident enough to not let their ego get in the way.

If you can do that, then you'll have the drive to persevere through pain, obstacles and rejection.

Why are we discussing mental toughness in a stock market blog? Simply put, a large part of our success in financial markets depends on our mental toughness. In financial markets we must get used to doing the uncomfortable in order to succeed. We always have to go against the crowd and pull the trigger in places on the chart that are scary to most people. Then it requires a certain amount of toughness to stay with a trade. It also requires a certain amount of toughness to abort and admit when something isn't working. I think you can see how important mental toughness can be.

from - THE FIBONACCI FORECASTER - Edited By Jeff Greenblatt

You may also like to read this related articles.

Sunday, August 13, 2006

>The Mentality of the Successful Trader

The Mentality of the Successful Trader

Successful traders thrive on instinct honed within a framework of trading rules. On occasion, a trader who fancies himself a writer will publish a list of his rules for public perusal. Such discourses, which typically postulate generic guidelines such as "Know yourself" and "Limit your losses," are useless to the novice reader because there is no way to truly appreciate the meaning of the rules except through experience. They are likewise useless to the experienced trader who already has an innate understanding of such things. Therefore, these self-help articles are just that: they only help the author himself.

What this trader turned writer hopes to accomplish is to help other traders develop a foundation for building their own sets of rules. Successful trading starts with a proper mentality, not a list of ambiguous guidelines. To begin, we must understand why most people are unsuccessful at the trading game. The short answer is that unsuccessful players are too emotionally involved. They personalize every decision and have egos which are easily offended by unprofitable trades. Many such market participants simply cannot cope with the loss of even small amounts of money.

These emotions, when roused, dominate the thought processes of the weak trader, causing mental distress. The trader beats himself up from the inside out, and all the energy consumed with regret and disdain reduces his capacity to make rational decisions on future trades.

Those that personalize the results of their decisions often practice the following poor behavioral patterns:

- They sit on losing positions with hopes of breaking even.

- They consciously or unconsciously enter trades in an effort to make up for previous losses rather than on the merits of the new trade.

- Despite a compelling setup, they do not open a new trade at a worse price than that which their last trade on the same asset was exited.

- And perhaps most perversely, they fail to execute well (or at all) on trading opportunities in which they have the highest levels of confidence. After all, they have the most to lose, egoistically speaking, in these situations!

(For a more insight on the neuroses suffered by poor traders, grab a copy of Justin Mamis' When To Sell.)

Successful traders, on the other hand, tend to be those who are most capable of handling the stress associated with a losing trade. They do not personalize the results of their decisions, and are therefore able to trade in a manner that protects their capital rather than their egos. Successful traders realize that there is no such thing as right and wrong in trading because the outcome is always uncertain. To the professional, there is only trading well or not trading well, and trading well means avoiding patterns of behavior that offer low probabilities of success.

To the dismay of individual traders the probability of success for each trade or trading system is not quantifiable. Granted, there are computerized trading systems that make fortunes via the algorithmic use of statistical analysis, but even for these systems, the success rate of each algorithm is dynamic and therefore never precisely known at any given point in time. Therefore, to trade well, one must develop a methodology of subjective judgment, and this methodology can only come from experience. Understanding the technical and fundamental forms of objective analysis are essential, but will not work well without a honed instinct. Subjective traders have a keen intuition, developed from years of experience, the desire to read voraciously, and the ability to utilize subconscious reasoning. (George Soros once revealed that he would close a trade if his preoccupation with the position made his back ache.)

Trading subjectively without personalizing results is perhaps the great quandary with which all traders struggle. After all, we all want to enjoy being right. We want to feel smart when a trade works out as hoped. But in reality, we must train ourselves to enjoy being successful while maintaining enough discipline to avoid judging ourselves by the profitability of each trade. The disciplined professional will not be unhappy with an unprofitable trade which he feels was well-executed, nor will he commend himself for the profitable, but poorly executed trade.

A well-executed trade is one implemented within the framework of one's own set of rules. Every set of trading rules must incorporate two essential components. First, they must contain strategies that reflect the nature of the trader. Markets are characteristically complex, reflecting the psyches of millions of players, and each trader must discover which approach to trading best suits him. In other words, which subset of market psychology can one profitably attack?

Second, all rule sets must contain an element of risk control. Risk is controlled both in objective terms: by not overexposing oneself to the potential for unbearably large losses, and in subjective terms: by trading within the purview of one's mental strengths so as to best choose entry and exit points (see Alexander Elder's Entries & Exits). By devising rules based on one's own strengths, a trader is able to approach the game with confidence rather than doubt. Doubt leads to duress, and it is under this circumstance that rules are abandoned, trades are executed from weakness rather than strength, and big losses are recorded.

>Why is Trading Difficult

Reality is what it is.

In most, if not all other profession's failure can be rationalized.

A lawyer might say he had no case, a doctor might say he did all he could it was "in the hands of God", but in both cases they get paid.

However at the end of a trader's report period, be it a day, a month, or a year he will either show plus or minus capital.

There are no excuses, traders don't get paid for failure.

"The symbol of all relationships among (rational) men, the moral symbol of respect for human beings, is the trader. We, who live by values, not by loot, are traders, both in matter and in spirit. A trader is a man who earns what he gets and does not give or take the undeserved. A trader does not ask to be paid for his failures, nor does he ask to be loved for his flaws."

Ayn Rand, The Ayn Rand Lexicon

>Trading with an open mind

Other studies suggest that we see only what we expect to see, and thus become blind to new realities -- much like the Florida sellers.

Laurence Gonzales, in his fascinating book "Deep Survival: Who Lives, Who Dies, and Why", describes a research study from Harvard psychologists. They showed people a film of basketball players passing the ball to each other. During the film, a man in a gorilla costume walks into the middle of the action and stays visible on the screen for about five seconds. One group of subjects was asked to count the number of passes among the players; the other group was simply asked to watch the film. Incredibly, 56% of the subjects who counted the passes didn't ever see the gorilla. Of course, everyone asked to simply watch the film noticed the gorilla man on the basketball court.

The point is that the brain is a kind of search engine: a Googler of reality. If we program our search to look for passes among basketball players, that's the output we receive from the brain. What is extraneous to our search (gorillas) is eliminated. When we conduct a broad search, we receive a wider range of outputs. Focused searches work well if we're looking for a specific item, such as lost car keys. They don't work so well when we need to process all of the information needed to survive in an environment of risk and uncertainty.

It is very easy to approach the markets in focused search mode. We develop a hypothesis about the market (bullish or bearish) and we prime ourselves to look for certain chart patterns or indicator readings. In our haste to find what we're looking for, we can miss the gorillas in the market. Afterwards, we might look back on market action and think, "How in the *^#@ could I have missed that??!!"

Gonzales writes, "The practice of Zen teaches that it is impossible to add anything more to a cup that is already full. If you pour in more tea, it simply spills over and is wasted. The same is true of the mind. A closed attitude, an attitude that says, 'I already know', may cause you to miss important information. Zen teaches openness. Survival instructors refer to that quality of openness as 'humility'. In my experience, elite performers, such as high-angle rescue professionals, who risk their lives to save others, have an exceptional balance of boldness and humility..." (p. 91).

Gonzales has provided a concise formula for trading success: boldness and humility. The exemplary trader has the boldness to act with conviction, and the humility to realize that what is apparent may not be all that is there.