Day Trading Vs

Informed Trading.

Often people ask how they can minize losses in trading.=> The simple answer is to understand why looses happen. ( think more on this)

Which is more powerful Day Trading or Swing Trading.=> Knowing the reason to put a trade is the source of power. The reason includes the time frame also.

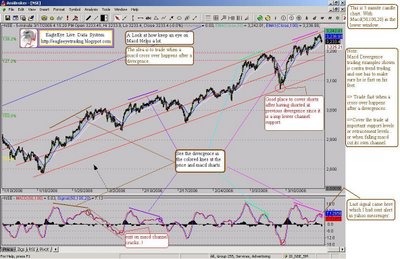

Will softwares like AdvancedGet or MetaStocks Exploration Or Ami Scans help me make profits?=> You make profits when you understand what you do and get more efficient at it. If you use software as your slave and make them do what you want, its an intelligent process.

If you make Sofwtare your master and depend on them for your decisions, most likely the future would turn sour.

How can one turn into a trader who makes more profits?=> The easiest way is to read, read, read and think.

Define your skills and risk taking capacity.

For example: People who cannot sustain huge swings (+ or -) in portfolio should restrain to cash stock trading.

I would emphaise the reading part. Read as much as you can. Reading would lead to thinking and thinking helps in looking at all sides of a coin, which makes for productive use.

What has Risk Management got to do with Trading?I have very often emphasised on appreciating and calculating risk and keeping risk at the core of ones trading. When risk calculations are kept aside and one goes "hot headed" in the trading hole the results are orgasmic. (very rarely pleasant and most often its a painful ordeal)

What does risk calculation means?

It can come down to as easy as finding how much money to put in each trade, setting a maximum loss for each trade and the most important of all knowing WHY the trade is taken.

Knowing this WHY helps in getting out of a trade also.

People who enter trade WITHOUT any well defined (thought)reason very often get stuck.

Just like 007 James bond, always keep in mind the reason for entering a trade and when to quit and keep the exit options ready..

Does using sophisticated systems and High Speed Data helps make more profits.=> The reason and time frame for your trading should dictate the complexity of your systems and data speed.

A person who trades once in 6 months and holds positions for a long time would not need realtime 1 min OHLCV data.

A person who trades 2 times a day or once in 2 days would make more profits having a speedy system which helps and alerts him in making faster decisions.

(even then keep the computer as a slave and not as a master)